Buying your first home is an exciting milestone—but it can also feel overwhelming. Friends, family, and even coworkers may flood you with advice based on their own experiences. While some of it may be helpful, it’s important to remember that every buyer’s journey is unique. Unfortunately, a lot of myths about homebuying are still floating around, and believing them could hold you back.

Let’s debunk five of the most common myths so you can feel confident and empowered as you begin your homebuying journey.

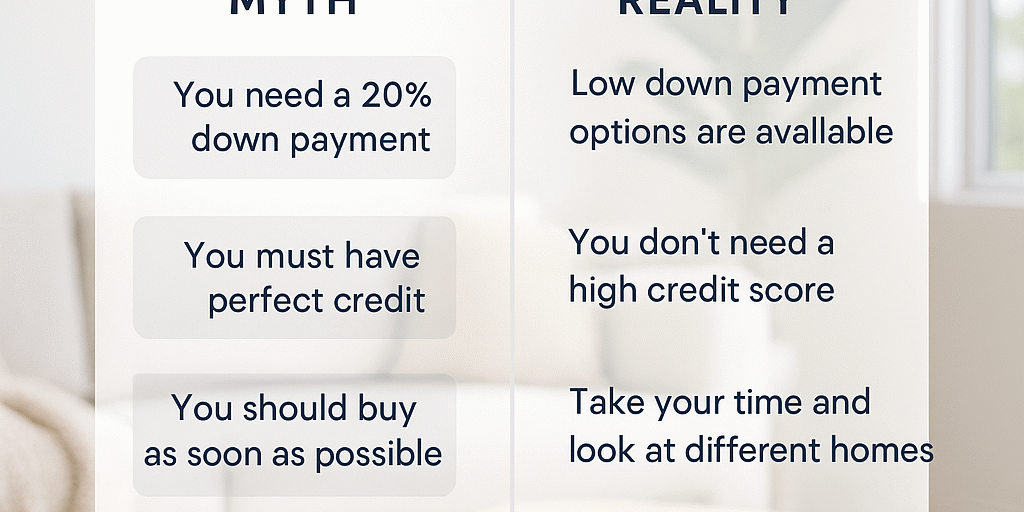

Myth #1: You Need a 20% Down Payment

For years, people have believed that you need to save 20% before you can buy a home. The truth? Many loan programs today require far less. Options like FHA loans or conventional loans may only require 3%–5% down. Saving more can help you avoid costs like private mortgage insurance (PMI), but don’t let the 20% myth stop you from exploring your options. Talk to a trusted lender to find the best fit for your situation.

Myth #2: Perfect Credit Is Required

A high credit score certainly helps you secure better loan terms, but it isn’t the only path to homeownership. Many lenders work with buyers who have less-than-perfect credit, sometimes even scores under 650. What matters most is connecting with a lender who understands your financial picture and can help guide you toward improving your score if needed.

Myth #3: You Should Buy as Quickly as Possible

This myth can create unnecessary pressure. Buying a home is one of the biggest financial decisions you’ll ever make—there’s no reason to rush. Take your time, explore neighborhoods, and make sure the property you choose truly fits your lifestyle and long-term goals. A thoughtful approach will serve you far better than a hasty decision.

Myth #4: You Can Skip the Home Inspection

An inspection might feel like an extra expense, but it’s a critical part of protecting your investment. Even if a home looks flawless, inspections often reveal hidden issues like water damage, mold, or foundation problems that could cost thousands to repair later. Always schedule a professional inspection before closing—think of it as an insurance policy for your peace of mind.

Myth #5: Location Is the Only Thing That Matters

Yes, location is important for long-term value, but it isn’t the only factor that affects your happiness in a home. Consider things like school districts, property taxes, neighborhood amenities, commute times, and even community vibe. The best home is one that balances location with the lifestyle you want.

The Bottom Line

Advice from family and friends comes from good intentions, but homebuying isn’t one-size-fits-all. By separating myths from facts, you can make informed decisions that work for your unique circumstances.